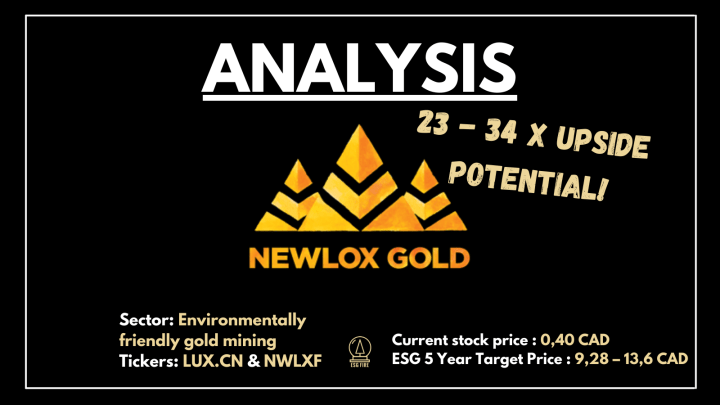

Company: Newlox Gold Ventures Corp

ESGFIRE 5 year price target: 9,28 -13,6 CAD

Listings : Canadian Securities Exchange, Frankfurt , US OTC Pink sheets, Formal US OTC in progress

Tickers: LUX, NGO , NWLXF

Market cap at time of publication: 48,79M CAD

Stock price at time of publication: 0,40 CAD

Number of shares fully diluted 190,390,637

Business: Environmentally friendly and socially responsible gold mining

Market Size: US$27bn – US$180bn

Website: https://newloxgold.com/

Short summary:

We are initiating coverage on Newlox Gold which is a junior gold mining company like no other on the public market. In fact it’s more fair to call Newlox Gold an Environmental remediation company. Newlox Gold’s works with local artisanal miners (with which they share profits ) to clean up historical mining waste while simultaneously recovering precious metals. They have developed revolutionary technology that recovers precious metals from historical mining sites, waste areas as well as recently mined rock using non-toxic reagents. Since the company’s unique OAR technology uses NO water in the extraction process this is as ESG friendly as it gets in the gold mining industry. The OAR technology which currently is planned to commence in-field testing later this year or early in 2022 is further explained below. The company is initially targeting an untapped US$27bn market using a solid low capex business model. Newlox Gold technology could potentially be applied to the whole formal gold industry valued at US$180bn. Seeing as there are almost no formal companies focusing on the artisanal mining industry Newlox Gold has a great first mover advantage.

The business idea of Newlox gold is to extract gold, silver (and other metals in some projects) by working with local artisanal miners. In simplified terms the company recovers mainly gold from historical waste material as well as ore mined by artisanal miners in Latin America. The implication of this is that the projects that the company execute have far less risk than other junior gold miners. Junior gold mining companies typically spend millions of dollars to find gold but Newlox Gold already knows where to find it. For example Newlox Gold does not have to perform expensive geological examinations nor do they need to perform expensive drilling projects and instead they can work in areas which have historical and ongoing gold mining. Traditional artisanal mining technology can extract only 40 % of the gold it mines, Newlox Gold technology on the other hand can extract over 90 %.

The initial project for the company is in Costa Rica. This is a country that has suffered environmental damage from mercury use in gold recovery by artisanal miners. In the second quarter ongoing, the plan is to ramp up gold production from tailings at its first plant and commission a second plant in Costa Rica to crush ore to be brought there by miners. Newlox Gold also plans to initiate a third and fourth project in Brazil as recently announced. The operations are fully funded for both projects in Costa Rica and for the Due Diligence being performed in Brazil and they plan to finance further expansions mainly using existing cashflow or debt financing, so it does not dilute shareholders. The company is basically debt free apart from a convertible debenture totalling 4 MCAD.

The goal for Newlox is to become a mid-cap gold producer within the next 5 years.

Stock history background

Newlox Gold went public in 2014 through the purchase of a shell company and their first financing was done at $0.05 CAD with a $0.10 warrant. The road has not been fast or straight, but the company is now quickly approaching profitability and we believe the company has enormous potential moving forward despite a huge return on the share price in the last 12 months. The company has achieved significant milestones lately which has fuelled the surge in the share price meaning there are fundamentals to back the latest increase in the share price. Recently famous Canadian investor Robert Mc Whirter has invested in the company and have brought with him a lot of attention from the general investor community [1]. We see it as a strong bullish signal that Mc Whirter has chosen to invest in Newlox, he reportedly purchased shares at 22 cents originally.

Ownership structure

Insiders and other persons/corporations who are considered close to insiders hold approximately 30 % of the shares in Newlox Gold. Current institutional ownership is hard to come by however participation in company’s financings has been made by several institutions such as Canaccord, Desjardins, Hampton, and Quinsam Capital. Quinsam Capital and its principal, Roger Dent, at one point filed statements that it held over 10% of Newlox Gold. As previously stated, famous Canadian investor Robert McWhirter has also recently disclosed that he has taken a considerable position in the company.

Technology and market overview

The global market for gold should reach $189.6 billion by 2022 up from $163.9 billion in 2017 at a compounded annual growth rate (CAGR) of 3.0% from 2017 to 2022.

It may be rather unknown to the larger investment community that Artisanal and Small-Scale Mining (ASM) is a major source of mineral production in the world.[2] The typical ASM production facility is unfortunately associated with low safety, high levels of work accidents and poor environmental / health aspects. In many countries ASM workers use mercury for gold extraction. Mercury is used to mix with gold-containing materials, forming a mercury-gold amalgam which is then heated, vaporizing the mercury to obtain the gold. This process can potentially be extremely dangerous and brings with it significant health and environmental risks and not to forget also inefficient. Initiatives such as the Minamata convention, a global agreement, aims to reduce the use of mercury in gold production. For those who wish to read more about Artisanal mining without the use of Mercury we recommend reading below.[3] . Amalgamation technique which is being used by ASM miners is not favoured by the gold industry at large because it creates pollution and it is not very effective although the technique has been used before more effective methods were developed.

Newlox Gold is currently using a gold extraction technique called gravity and floatation technology for which they have designed a customized approach. This technology is widely used and does not require patenting. This technology uses a customized intensive carbon in leach (CIL) system which has been designed in partnership with the Company’s advisors at the Norman B Keevil Institute of Mining Engineering at the University of British Columbia. The company, according to management, plans to duplicate this process at each project to ensure they deploy a suitable system based on every projects individual conditions. Worth mentioning is that the company has a very strong technical team, good relationships with governments and university labs which adds credibility and strength on all projects executions. This technology is already highly profitable for the company.

Newlox Gold currently has a technology under development in late stage research used for recovering gold at a potentially higher than previously possible extraction rate and in a way which does not require mercury or any other harmful toxins. The technology, which is called organic aqua regia (OAR) also uses considerably less water than current methods.

Water management is a big deal in the mining industry; mining competes with other uses, such as domestic and agricultural, and any reduction in water use has significant advantages, especially in arid climates. Additionally, because the process does not use water as an input, there is no wastewater, or effluent, produced. This is a major environmental advantage because the management of effluent, and potentially chemical residues, is a major problem in the resource industry. This creates an extremely improved working environment for ASM miners, a more sustainable environment and contributes to an improved social community for local miners.

Newlox Gold has stated that they are currently not applying patents for this process however they may do this at a later time. The reason for this is, according to the company’s CEO that “The patent process can be lengthy and costly while providing international entities with process details for reverse engineering. At present, our strategy is to develop the technology, test it in the lab now and in the field at our processing plant later this year. We may enter the patent process once the technology is mature. We can begin marketing to third parties at that time, giving us a firm first mover’s advantage while being covered by patent pending. OAR is non-toxic, requires no water, and has delivered over 95% recovery in stage 1 testing. We are very excited by this research and are currently undertaking stage 2 R&D. “

Lastly the most exciting technology under development by Newlox Gold is the so called low-energy mercury remediation system. The company is developing this technology in a partnership with their advisor Luis Sobral at CETEM (the Brazilian National Metallurgical Lab).

Field testing has been done and a commercial sized unit is currently in process of being deployed. This technology will most likely be revolutionizing for the disastrousenvironmental effects that gold mining with mercury has caused.

To conclude Newlox Gold has several unique technologies which have been developed using a very little of the company’s time and capital, while delivering extremely promising results. The current value of the research and development department of Newlox Gold does not seem to be priced into the evaluation of the company by the market. Especially the organic aqua regia (OAR) system which could potentially change the whole way that the US$180bn formal gold industry is performing today and generate substantial licensing revenues! It should however be mentioned that this technology is currently in stage 2 research. The first round of testing showed that the technology could dissolve almost 100 % of ore material during elevated temperature at ambient Costa Rican levels. The next stage should be to test the scalability of the technology. We expect the company to provide a full report on the technology this fall (2021) and perhaps a teaser before this, according to the company’s latest webinar presentation (14/5 2021).

Business model

Newlox Gold intends to grow their business using a low capex business model using cashflow from ongoing operations for organic growth. The plan is to use the profits expected from projects in Costa Rica to finance the Brazilian expansion. This is very interesting for any potential shareholder since this could mean far less dilution than having to fund growth with repetitive external capital injections. The company already has full funding for their two first plants. The company also has an inhouse laboratory which means they can get lab results far quicker than having to wait several weeks and sometimes months to determine the quality of potential mining sites.

The current technology applied by the company has raised the efficient level of gold recovery from 40 % to 90+ % and according to our interview with the company the OAR system of their R&D project could raise this far above 90 %.

As previously stated, the company applies a profit-sharing model with their ASM mining partners. The two first projects are located in Costa Rica which is a democratic stable and developed country that has 98 % renewable energy production[4]. At the company’s first processing plant however, they are simply buying artisanal tailings, which is basically waste material, on a tonnage basis model. The company’s second project, also called the Boston project, has a 50/50 profit sharing agreement with local ASM miners. The way it works is local ASM miners supply the Newlox Gold facility with raw material from local mines and the company does the chemical processing. The great part of this is that it can reduce social and environmental problems that are normally accustomed with ASM mining. The miners in turn receive payment equal to the same amount of tonne they usually mine but it frees up more time for them to work on improving their community and with considerable added beneficial health aspects as they do not have to deal with mercury or any other toxic materials. The company calls this the “Partner mining model and we assume this model will be applied in other upcoming projects. Usually ASM miners are able to extract 40 % gold recovery rate from tailings, with Newlox Gold the local miner cooperatives get to profit split a recovery rate of 90 % without having to do the hard work of processing the tailings. The ASM miners are processing mined rock and getting 40% of the gold, Newlox is the only one processing tailings. Because of this, the local miners can earn the same amount per tonne that they normally mine by working with Newlox Gold, but they save a lot of time and effort as well as gain improved health since they do not need to use any toxic materials for their extraction. This in turn leads to higher profits while addressing the environmental and social issues usually associated with artisanal mining.

Each Newlox plant has a low Capital Expenditure (CAPEX) of between 2-3 million USD. The company expects all projects will pay back their entire capex in less than one year at full production. The 5-year plan of the company is to commission 2 new plants each year to reach a total production of +145,000 ounces per year. If this plan is successful it equates revenues of close to 260 million USD per year based on a gold price of 1816 USD per ounce.

Newlox gold activities have been well received by the government of Costa Rica as they provide a solution to a real environmental problem. We are expecting this welcoming to continue on other geographical locations where the company seeks to establish their business since they improve both the environmental aspects as well as the social aspects of the community where they are engaged.

The company currently operates with a 9 gram per tonne gold grade cut off because material at the grade is easily available. Gold prices does not have to increase for it to be profitable to process these tailings for Newlox Gold. The recently reported project one has total gold recovery cash costs of only $535 per ounce.

One big revenue aspect that could potentially transform the whole revenue model is if Newlox Gold manages to license out their OAR technology to other miners and mining sectors.

The revenue potential for this licensing could be far bigger than the company’s goal of +145,000 ounces per year / 260 Million USD in annual revenues.

5-year ESGFIRE price target: 13,6 CAD calculation

We believe the current plan of Newlox Gold to commission 2 new plants each year and reach production numbers of +145,000 ounces per year to be realistic. The reasons for our assessment is that the company has revolutionizing technology which has already proven to give an astoundingly fast return on capex in as little as less than a year. The company seems to have no visible problems finding new projects and they have so far been well received on all locations where they have established themselves. In fact the company’s 5-year plan may even be slightly overcautious as it does not take into account any revenues from technology licensing or joint venture partnerships.

At current gold prices the company’s 5-year production target would equal 260 million USD in revenues. Using conservative numbers and applying the 50 / 50 profit sharing model on the entire revenue stream the pre-tax profit should stand at 131 million USD. Using standard Canadian corporate tax of 28 % the net profit should be 94.32 million USD. These numbers are excluding any potential revenues from licensing out Newlox Gold technology or joint venture partnerships.

The current number of shares fully diluted is currently 190,390,637. Applying the 94.32 million USD net profit gives us an earnings per share of 0,495 USD.

Mature gold miners in Canada are currently valued between 15 – 30 X EPS. We will be using a 15-22 X multiple for conservative calculations.

Applying 15- 22 X EPS multiple on Newlox Gold’s possible 5-year EPS of 0,495 USD gives us an implied share value between 7,425 – 10.89 USD.

This equates to 9.28 – 13.61 CAD and a 23 – 34 X upside on today’s stock price at 0,40 CAD. We believe Newlox Gold due to its unique ESG aspects is worth to be valued at least at a multiple of 22 X earnings (if not higher) if they can reach their 5-year target.

Current ongoing operations

We will be assuming gold prices of 1816 USD per ounce in our calculations.

The two projects in Costa Rica are currently ramping up to produce at full scale in the next few months, according to the company’s latest investor webinar (13/7 2021) they are expecting to provide an update on this shortly. . Project number one in Oro Roca is estimated to process 80 tons of tailing per day with 9 grams of gold per ton. Applying a 90% recovery rate gives us 648 grams of gold per day or 20.83 troy ounces of gold. Applying 320 operational days per year gives us 6667 ounces of gold equaling 12.107million USD in revenues and with a cost of $535 per ounce the gross profit should equal 8.54 million USD per year for this project alone. Newlox Gold buys tailings from local ASM miners at a cost of 200 USD per truckload.

The second project called the Boston project is run with a profit-sharing partner model. Local ASM miners simply bring ore material to Newlox facility which saves them time and also pays better than extracting the gold by themselves. Local methods seldom give a higher extraction rate than 40% and with Newlox technology over 90% the ASM miners get 50% of the net profit without the excruciating and health damaging labour associated with their usual extraction that often uses mercury.

The production numbers are stated to be at 150 tons of tailing per day giving approximately 15 grams of gold per ton. With 90% extraction rate this equals 2025 grams of gold per day, or 65.1 ounces. Assuming operations of 300 days per year this should equal to 19531 ounces of gold extracted per year. Total revenue should stand at 35.47 million USD per year with a net profit after profit splitting of approximately 15 million USD using conservative figures. This project is expected to be in production this year and ramping-up to full scale in 2022.

On these two projects alone the total gross profit should therefore equate to approximately 23,8 million USD. In Costa Rica Newlox Gold has signed agreements with ALL local ASM mining cooperatives (according to CEO Ryan Jackson on investor webinar 13/7 2021). Currently Newlox Gold is doing due diligence for three projects in Brazil. The company already has the team on the ground and contacts necessary in Brazil thanks to Doctor Veiga and Doctor Giorgio De Tomi. Doctor De Tomi has worked closely with Doctor Veiga alongside ASM miners.

Doctor Veiga is of Brazilian origin and probably has the most knowledge about ASM mining globally. Therefore, it makes perfect sense for Newlox Gold to enter the Brazil as its next market.

To give a comparison of the size this market has it should be mentioned that in Costa Rica there is a total of 1000 ASM miners. A single project in Brazil on the other hand engages close to 6000 miners in one cooperative. The area that Newlox Gold is currently doing due diligence in had an active production of close to 5 tons of gold in 2020. According to the latest investor webinar by the company (13/7 2021) some drilling is being made and results have so far been very encouraging. The due diligence of Brazil is expected to be done later this year. Decision on which projects to go forth with and construction should begin early next year (2022). The infrastructure challenge in Brazil is greater than in Costa Rica which could pose some challenges for scaling up production. Having Doctor De Tomi on the team certainly helps since he is considered somewhat of a local hero in Brazil (According to the latest investor webinar by the company 13/7 2021) .

Upcoming catalysts for Newlox Gold Stock

– Sales numbers

Newlox Gold released their latest financials sometime at the beginning of August 2021 which did not show exciting revenues. However, they were early in the ramp-up of operations at Plant 1 in Costa Rica and recent company news shows that plant operations have reached 50 tonnes per day this summer. The recent update on operations stated that production is being achieved with a cash cost of approximately 535 USD per ounce and operations are now past the break-even point and continuing to grow.

– Initiation of new projects

Newlox Gold has already informed the market of two potential prospective areas suitable for gold extraction in Brazil. The projects are currently in due diligence. The initiation of these projects should be an important catalyst for the company. Other potential new markets for projects could be Ecuador, Peru, Colombia, Chile, Giana and Nicaragua (in which the company believes they are close to signing a deal according to the latest investor webinar 13/7 2021).

-Licensing of technologies

With the unique technology that Newlox Gold is developing we would not be surprised if the company took the chance to earn licensing fees from this once the technology is fully protected.

The mining industry has historically been very conservative since companies spend millions of dollars derisking projects with various tested and tried technology features. Newlox Gold will use their inhouse developed technology themselves and will have plenty of demonstration facilities to show potential customers if their various technology projects are proven to be successful.

-Expansion in Costa Rica

According to the latest operational webinar by Newlox Gold (13/7 2021) there are two other areas where the company could potentially expand into two other locations , these locations are according to the company a bit trickier to expand into due to regulatory factors however it’s not something that management is ruling out.

-JV partners

It’s not unlikely that the company might be approached by large joint venture partners who are interested in doing mutual projects using Newlox Gold technology. This could also provide an important share price catalyst. In the latest operational webinar (13/7 2021) management expressed that expansion beyond Latin America would likely be in the form of a Joint venture partnership.

-ESG premium on gold sales

It’s not inconceivable that a gold producer like Newlox Gold may be paid premium prices for their gold if they can develop some form of ESG standard that consumers are willing to pay higher prices for. With the global consumer market becoming increasingly aware of the environmental and social aspects of mining production this could prove to be an important differentiator.

-Profitability leading to dividends

Management has ambition for Newlox Gold to become a company that can pay out sizeable dividends and with their smart low capex business model this should prove to be an exciting upcoming catalyst.

– Quicker expansion with debt financing

The company currently only has roughly 4 million CAD in convertible debenture on the liability side.

A faster expansion with the help of loans and other types of debt financing could prove very lucrative for Newlox Gold. Stated during the investor webinar (13/7 2021) CEO Ryan Jackson does not rule out debt financing however plant 1 needs to come into full production in order to prove the business model for debt financing from banks. Since the company is currently fully funded for their first two projects and the due diligence period in Brazil, they count on being able to finance forward capex through a combination of internal cashflow, the continued exercise of existing convertible securities, and potential outside investment.

Risks associated with an investment in Newlox Gold

Although we at ESGFIRE consider Newlox Gold to be a far less riskier investment than other junior gold miners there are several risk aspects that investors need to be aware of.

The section below addresses some, but not all, risks associated with an investment in Newlox Gold.

–Political risks

The current geographical locations which Newlox Gold are currently active in (Costa Rica + Brazil) have stable democracies and prospering economies however, as these are located in Latin America, this is not something which can be taken for granted. Investors should be aware that political turbulence can affect an investment in the company negatively.

-Uncompliant local miners

One risks risk is that the local miners may not want to participate in the company’s endeavours, but these projects have government support because of the environmental concerns. Seeing as local miners also make the same amount of money with far less work, we view this as a miniscule risk.

-Fluctuations in gold prices

Gold prices are currently at an historical all time high. Fluctuations in gold pricing will most certainly affect the profit and revenues of Newlox Gold. The advantage that Newlox has however is that their cost of production is considerably lower than for other junior gold miners. However, this is a risk that must be considered.

https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

-Covid-19

Production had to be shut down in June 2020 at Newlox plant 1 due to Covid-19 and was reopened in November the same year. Production remained steady throughout the second wave of cases in Costa Rica so hopefully the facilities should be able to work without shutting down despite new waves of Covid-19. This is however a risk that should be addresses since production could be halted at some or all facilities if there is a peak in local cases.

-Technology intrusion

Newlox Gold has the ambition to patent their unique OAR technology. Since the technology is revolutionizing it’s not unlikely that competitors may attempt to either reverse engineer or simply copy the technology which could result in costly legal battles for the company.

-Technology risks

Newlox Gold’s revolutionizing OAR (organic aqua regia) technology has yet to be tested on a large scale. The company has received results which are very promising and at this stage it’s a matter of being able to scale at a big enough size. One interesting aspect of this is being able to recycle the reagent of the process which commercial actors have shown interest in. Should the technology not work on a large scale this could significantly affect the company’s business model.

Management overview

Our loyal followers know we only invest in companies that have a great management team and our investment in Newlox Gold is no different. The company hosts an impressive line-up of executives and advisors described below.

Management team

Further introduction:

Ryan Jackson CEO

Holds degrees from McGill University in environmental science, with an emphasis on human health, and political science. He has worked in the mining industry both in the field and in the boardroom and spent three years as the Canadian editor of an international mining industry magazine. Ryan’s experience in the industry includes field work, primarily in Latin America, as well as business development in North America, Europe, and East Asia.

Jeffrey Benavides CFO

Jeffrey Benavides, Chief Financial Officer – Resides in Costa Rica and manages the accounts payables, receivables, payroll, cost controls, purchasing systems, and inventory control. He is an experienced chartered accountant and computer engineer with extensive managerial experience and a background in mining. Mr. Benavides has over a decade of experience in mining in Latin America and manages a capable team of engineers, geologists, and technical personnel.

Dr Giorgio de Tomi – a valuable edition for the Brazilian expansion!

Dr. de Tomi has over 30 years of experience in the resource sector and has a degree in mining engineering from the University of Sao Paulo, a Ph.D. from the Imperial College, London, and an MSc from Southern Illinois University, USA. He leads the Centre for Responsible Mining, at the University of São Paulo (USP) in Brazil, as an associate professor and former Head of the Department of Mining and Petroleum Engineering. Dr. De Tomi is a Fellow of The Institute of Materials, Minerals & Mining (FIMMM, UK), Chartered Engineer CEng (Engineering Council, UK). He is a member of SME (USA) and acts as mining QP and CP for numerous mining enterprises worldwide. Currently, he is a member of the Technical Board of CBBR (Brazilian Commission for Mineral Resources and Reserves), a member of the Executive Board of EMBRAPII’s Unit Tecnogreen, a Research Scholar with FAPESP and CNPq (Brazil) and a member of the Editorial Board of the Mining Technology journal and the Brazil Mineral journal (Please see the link here to Dr. De Tomi’s professional biography: https://bit.ly/3qd93PQ).We believe the recent addition of Dr De Tomi will be very valuable for Newlox Expansion into the Brazilian market since he has an extensive contact network and has professional experience working in Brazil.

Advisory board

Further introduction:

Marcello Veiga, Chief Technical Advisor – Has over 40 years of experience in the resource field, including degrees in Metallurgical Engineering, Environmental Geochemistry, and a doctorate in Mining and Mineral Process Engineering. Dr. Veiga is a professor at the Norman B. Keevil Institute of Mining Engineering at the University of British Columbia and was the Chief Technical Advisor of the GEF/UNDP/UNIDO Global Mercury Project based in Vienna. Marcello is the global academic leader in artisanal mining and is a well-versed in the technical, environmental, and social challenges of working with artisanal mining. Doctor Veiga is considered one of the leading scientists of the global mining industry and his participation in Newlox Gold is an extreme quality stamp for Newlox Gold.

Competitors

Below is not a complete list of competitors but we have chosen the most relevant ones for Newlox Gold comparison.

Bactech Environmental corp – Market cap 9 MCAD

https://bactechgreen.com/

BacTech’s is planning to build a 50 tonnes per day bioleach plant capable of treating high gold/arsenic material in Ponce Enriquez, Ecuador. According to their calculations A 50 tpd plant, processing 1.5 ounces of gold per tonne of feed, would produce approximately 26,000 ounces per year. Plant designs are modular and can be expanded without affecting ongoing production. The actual capex per plant is calculated at approximately 10M USD which is 5 X more than the capex of Newlox Gold. However, test results have shown promising results with gold recoveries of 99.4% and 100% for prospective plant feeds validated (announced April 21, 2021) through ongoing ALS diagnostic test work. The first plant is planned to commence construction in Q1 of 2022.The company seems promising but have not yet proven anything on a larger scale.

Dynacor – Market cap 98 MCAD

Dynacor is a dividend-paying industrial gold and silver ore processor headquartered in Montreal, Canada. The corporation is engaged in gold production through the processing of ore purchased from the ASM (artisanal and small-scale mining) industry. At present, Dynacor operates in Peru, where its management and processing teams have decades of experience working with ASM miners. It also owns a gold exploration property (Tumipampa) in the Apurimac department. They are expecting to process approximately 375 tons per day in 2021. Dynacor produces environmental and socially responsible gold through its PX IMPACT® gold program. The artisanal miners benefit via reinvestment of the premium into their communities Dynacor is trading at P/E ratio of 20 which makes us confident that Newlox Gold should at least be trading in the same range. The fact that they have been able to sell gold at a premium also makes us confident Newlox Gold should be able to do the same thing.

Conclusion

We believe Newlox Gold is the most ESG friendly and safest (although obviously not risk free) bet on gold in the public market. Their technology has largely been proven, they are approaching full production and their capex is currently fully funded. Management has a great track record and the participation of Doctor Vega and Doctor De Tomi adds both credibility and serious leverage when negotiating with governments and other stakeholders. What remains to be seen is if management can scale up as quickly as they have planned, according to management it does not seem to be a lack of potential mining sites in their targeted geographical area. With close to a 30 bagger potential based on the company’s own 5 year projections excluding any potential licensing revenues or JV projects. We believe now is the time to jump on the journey with Newlox Gold and that this is truly an investment everyone can feel good about from an ESG perspective. The company truly improves both the environment and the social aspects of the local population on all fronts where they are in business.

3 quick questions with Ryan Jackson, CEO of Newlox Gold

ESG: 1. What catalysts are you most looking forward to in the next 6 months for Newlox Gold?

Ryan:

Newlox Gold has four main initiatives currently underway; ramp-up of productivity at Plant 1, construction at the Boston Project, expansion into the Brazilian market, and technology development. In the next six months, we believe that the catalysts will be the achievement of full-scale operations, and the associated cashflow, at Plant 1, commissioning of the Boston Expansion Project in Costa Rica, and the announcement of our first Brazilian project.

ESG : 2. How do you view your current funding capabilities and liquidity position?

Ryan:

The Company currently has a strong treasury and is fully funded for the ramp-up of Plant 1 and the completion of construction and commissioning at the Boston Expansion Project. Part of our financing strategy is the expectation that the Company’s investors will exercise their convertible securities. All the warrants outstanding a firmly in the money, and we are regularly receiving wire transfers to top up the Company’s treasury. This represents financing that does not require more legal or finder’s fees and supports Newlox’s regional expansion strategy. The combination of internal cashflow and financing from warrant exercise will likely make up a large percentage of the initial funding for our medium-term plans.

ESG: 3. What do you see as the biggest challenges for Newlox Gold to reach its goal of extracting +145,000 ounces of gold in 5 years?

Ryan:

Newlox Gold is growing rapidly; however, it is still a small company. Because of this, human resources are the major consideration when executing our regional growth strategy. We have access to a strong pipeline of expansion projects in many countries, the major reason we picked Brazil is because Company has excellent contacts there including experienced and trustworthy engineers and geologists. Growing our team, especially in new jurisdictions, will be an exciting challenge for us but we benefit from the legions of young engineers who have trained under Dr Veiga, Dr De Tomi, and Dr Sobral over the years.

[1] https://ticotimes.net/2020/12/18/costa-ricas-electric-grid-powered-by-98-renewable-energy-for-6th-straight-year

[1] https://www.stockwatch.com/News/Item?bid=Z-C:LUX-3026396&symbol=LUX®ion=C

[2] https://www.oecd.org/daf/inv/mne/artisanal-small-scale-miner-hub.htm

[3] https://www.epa.gov/international-cooperation/artisanal-and-small-scale-gold-mining-without-mercury

[4] https://ticotimes.net/2020/12/18/costa-ricas-electric-grid-powered-by-98-renewable-energy-for-6th-straight-year

Legal Disclaimer:

We own shares of this company personally.

Investing in stocks is combined with certain risks and it is possible to lose your entire investment. My posts are made for Educational purposes only and are not to be interpreted as tips , financial advise or recommendations of any kind to either buy or sell any stocks.

Companies may or may not be paying us for content posted on this blog.